Content

However, putting it in as a Transfer nullifies the amount as if $0 came out of my account. The only other advice I’ve received from QB is to upgrade to Simple Start. Intuit QuickBook’s aim is to help simplify various repetitive business tasks into one seamless integrated technology solution.

You must use the expense and revenue categories that come with QuickBooks Self-Employed. A chart of accounts allows you to customize the rows you see on your profit and loss, to see what is behind your income and expenses . In QuickBooks Self-Employed, you only get the “tax” categories as hard coded by Intuit. As implied by the products mentioned here, QuickBooks is meant primarily for self-employed individuals and for small businesses that need up to 5 users doing the bookkeeping.

Tracking Your Taxes

QuickBooks does offer a few other customer service options, but finding the information you need might be a little tough. For example, they have a community forum, but it’s not strictly for the Self-Employed program. Choosing a plan for QuickBooks Self-Employed is made easy, as they only offer three plans. If you are ready to ditch that Excel spreadsheet and get your income and expenses organized, sign up and receive 50% off the first three months. There are also some minor user interface and navigation differences once you get into the working screens themselves.

It will help you track your deductions and utilize the information to fill out taxes to get benefits on Tax returns. The mileage tracker of QuickBooks Self-Employed can be downloaded on your iOS and Android. It will automatically monitor all of your car travel and record your business miles with deductions based on IRS mileage rates. The QuickBooks Self-Employed offers numerous features to its user.

How can I add payroll feature to my self-employed QB account?

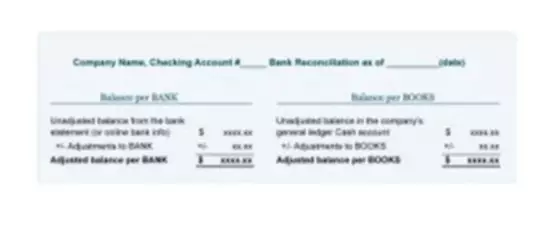

Rules can be applied retroactively, and you can also mark a specific bank account as “mostly business” to take some of the legwork out of organizing your books. Quickbooks Online is designed to track the transactions of business accounts. It has more advanced features, so it can track sales tax, keep track of inventory, etc. If you’re running a business, regardless of size, you instinctively know how important accounting is to long-term success.

No need to manually calculate mileage deductions for every work-related trip. QuickBooks Self-Employed will automatically do the math for you using the current IRS mileage rate. Just opt into mileage tracking via the app to automatically log all of your car travel. QuickBooks keeps a running tally of business miles and the corresponding deduction. You can also manually enter trips using the app or web service. Using the QuickBooks Self-Employed app, quickly mark income and expenses as business or personal with the swipe of your finger.

Documenting and organizing receipts

Mary Flory leads NerdWallet’s growing team of assigning editors at large. Before joining NerdWallet’s content team, she had spent more than 12 years developing content strategies, managing newsrooms and mentoring writers and editors. Her previous experience includes being an executive editor at the American Marketing Association and an editor at news and feature syndicate Content That Works. • Receipt scanner enters transaction information easily stores receipts. Note that star rankings are subject to frequent review and may be updated at any time. Schedule C is an IRS form that accompanies Form 1040 to determine business net income .

- • Receipt scanner enters transaction information easily stores receipts.

- More specifically, it’s for sole proprietors who need a little help staying organized.

- If you want to collaborate or add users to a growing business, QuickBooks’ small-business user limit maxes out at 25.

- QuickBooks Online is also much more expensive than QuickBooks Self Employed.

- You can call, email, or schedule an appointment with your account manager.

You can also search your transactions if you need to find a specific item. With this feature, you can automate certain tasks such as reminders and triggers to help you save time and improve cash flows. Allows you to quickly see project profitability in easy-to-read reports. Each variant also caters to different needs, though, as small businesses and self-employed individuals have different things to worry about on a daily basis.

Yes, it is free to invite an accountant for the collaboration. You have to send an invite and when they accept it then they can easily work with you. In self-employed tax, there is a part that goes to Medicare and social security from every American’s income.

The platform will calculate your quarterly tax liability, and the QuickBooks Self-Employed Tax Bundle allows you to pay the quarterly tax online. I5 may help avoid a federal underpayment penalty but doesn’t include state-estimated tax payments, which might be due, depending upon where you live. Remember that to pay your federal quarterly taxes through QuickBooks Self-Employed, you need to sign up for the Electronic Federal Tax Payment System . Based on the tax profile that you complete during setup, QuickBooks Self-Employed will project your annual profit, calculate your estimated tax payment, and alert you of tax due dates. This valuable tool helps protect you from an underpayment penalty because of not making the required quarterly estimated tax payments. Just be sure to stay up to date on categorizing your transactions and inputting your business income.

The WorkersCenter accessible from the left navigation pane is where you’ll find both the Employeesand Independent Contractortools you need to make these task easier. quickbooks payroll self employed The expenses can be easily tracked and sorted by importing them directly from the bank account. Sort your expenses of business from the personal expenses by swiping.