The purpose of full disclosure is to provide users of financial statements with a complete and accurate understanding of an entity’s financial performance and position. As one of the principles in GAAP, the full disclosure principle definition requires that all situations, circumstances, and events that are relevant to financial statement users have to be disclosed. In other words, all of a company’s financial records and transactions have to be available for viewing. Required disclosures may be made in (1) the body of the financial

statements, (2) the notes to such statements, (3) special

communications, and/or (4) the president’s letter or other management

reports in the annual report. Another aspect of completeness is fully

disclosing all changes in accounting principles and their effects. It matters because if investors feel they have been defrauded by your company and take you to court over it, this could lead to fines or even imprisonment for those responsible.

- It can lead to fewer lawsuits from those who feel they have been defrauded and increased productivity among employees because everyone will know precisely what is expected of them and where their money is being spent.

- Management typically provides a narrative response to questions about the company’s operations.

- This is an example of a company violating the full disclosure principle because the sale is a material event that should have been disclosed.

- There are situations where full disclosure is not required, but is still advisable.

A copy of Carbon Collective’s current written disclosure statement discussing Carbon Collective’s business operations, services, and fees is available at the SEC’s investment adviser public information website – or our legal documents here. Company conference calls can, and often are, be recorded to be used to provide more clarity on the annual reports. If the company has sold one of its business units or acquired another one, it must disclose this transaction and its complete details in its books including how this transaction will help the company in the long run. Since, the external users of financial information lack any kind of information on how business is run, the full disclosure principle makes it easier to determine how a company is functioning. In contrast, companies that choose to disclose information that is material to investors are more likely to receive the benefits of enhanced risk management, such as better allocation of resources and improved decision-making. The full disclosure principle has also been criticized for putting too much of an emphasis on the financial aspects of a company and not enough of an emphasis on other reporting requirements.

Everything You Need To Build Your Accounting Skills

For example, in June 2002, an audit of WorldCom revealed that it had overstated its assets by over $11 billion. Even so, investors lost over $2 billion due to the stock devaluation that followed the financial fraud. Some accounting policy changes include inventory and revenue recognition, depreciation method, provision for bad debts, goodwill written off, etc. Entire disclosure matters in an organization to develop faith and trust in the other employees and work together to achieve organizational goals. This can lead to 2 outcomes, one with a positive impact and the second with a negative impact on the financial health of the business. According to the journal by Azhar Susanto, Meiryani, it is stated that full disclosure is proper and detailed disclosure of company information regarding financial information and management, which the general public must be aware of.

BUS103: Introduction to Financial Accounting

The dine, shop and share is part of the Generally Accepted Accounting Principles (GAAP) standardized accounting framework. Information is disclosed in notes on financial statements to satisfy the full disclosure principle. The full disclosure principle applies to the balance sheet, the income statement, the statement of cash flow, and the statement of owner’s equity.

Full Disclosure Principle Overview, Purpose & Importance

Without this principle, it would be highly likely that companies would withhold information that could possibly put the company’s financial position in a negative light. Disadvantages would include people feeling as if they have been defrauded by your company and taking you to court over it. When there are undisclosed transactions on financial statements, investors cannot make informed decisions, leading to poor investment choices or missed opportunities. It is also challenging to keep track of all transactions and assets/liabilities, which can lead to mistakes that are easily avoidable with full disclosure. The full disclosure principle ensures that all-important and relevant information is disclosed to the shareholders and no material item remains undisclosed. This must be done in a proper manner as per the applicable accounting standards and regulations.

Disclosures are typically required for items that are considered to be material, which means they could potentially impact a reasonable person’s decision to invest in a company or have a significant impact on a company’s financial statements. Materiality can be defined as something which affects the decision-making process of a person. A company should ensure that even the smallest detail which can be described as the material is shown in the financial statements. If they cannot be shown in the financial reports, they must be included in the footnotes after the reports.

The most notable examples are the Enron scandal in 2001 and Madoff’s Ponzi scheme discovered in 2008. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including MarketWatch, Bloomberg, Axios, TechCrunch, Forbes, NerdWallet, GreenBiz, Reuters, and many others. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. This is one of the most important components of the full disclosure principle as they are supposed to ensure that all-important information has been correctly disclosed.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Be honest about whether or not a transaction has occurred and disclose any relevant information, even if it is embarrassing or unpleasant for either party involved. Full disclosure typically means the real estate agent or broker and the seller disclose any property defects and other information that may cause a party to not enter into the deal. This team of experts helps Carbon Collective maintain the highest level of accuracy and professionalism possible.

The principle of full disclosure is also relevant to the choice of what types of financial information should be disclosed in financial statements. When an auditor concludes that an organization’s financial statements are fairly presented in all material respects, this is called an unqualified audit opinion. However, there https://simple-accounting.org/ are many circumstances under which a necessary caveat must be added to the audit opinion. Auditors are also required to describe how they arrived at their audit opinions on an organization’s financial statements. The requirements for full disclosure can vary depending on the jurisdiction in which the company operates.

The Full Disclosure Principle is a concept in business ethics that requires companies to be transparent and honest in their financial reporting. The full disclosure principle helps ensure that audit and tax professionals have access to all the necessary information for financial statement audits and accounting purposes. This enables them to make informed decisions about whether to invest in the entity, extend credit, or engage in other transactions. If your Financial Statements use IFRS, IAS 1 Presentation of Financial Statement should be applied.

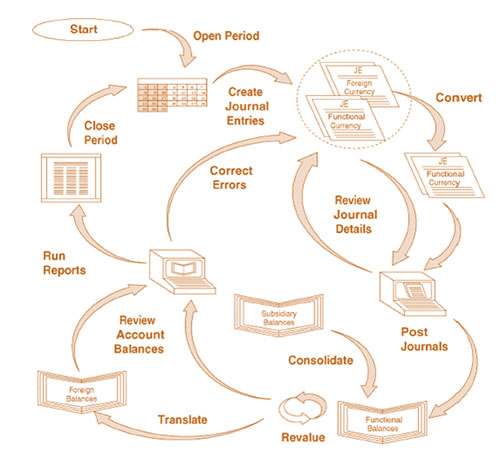

GAAP sets the rules that accounts follow when making journal entries and standardizes accounting so outside parties can make comparisons between companies. Investors, creditors, even employees count on the consistency of financial reporting to evaluate operations. When you disclose all relevant information in your financial statements, it demonstrates good faith and trustworthiness to the people you are doing business with.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. When applied correctly, this principle will help maintain trust with your shareholders and investors. Full disclosure also refers to the general need in business transactions for both parties to tell the whole truth about any material issue about the transaction. For example, in real estate transactions, there is typically a disclosure form signed by the seller that may result in legal penalties if it is later discovered that the seller knowingly lied about or concealed significant facts. Additionally, management’s perspective on the risks and mitigating factors (i.e. solutions) must be presented – otherwise, there is a breach of fiduciary duty in terms of the reporting requirements. Disclosing all material financial data and accompanying information pertaining to a company’s performance reduces the chance of stakeholders being misled.

Does the Full Disclosure Principle matter?

In case there is any doubt auditors have the authority to send confirmation queries to any third party. Second, it is assumed that all relevant information should be included in financial reports. Additionally, some information may be complex and difficult to understand, which can make it difficult for stakeholders to make informed decisions.

Full Disclosure Principle is an accounting convention requiring that a firm’s financial statement provide users with all relevant information about the various transactions a firm has been involved in. The full disclosure concept is not usually followed for internally-generated financial statements, where management may only want to read the “bare bones” financial statements. In this situation, management is assumed to already have full knowledge of the items that would otherwise have been disclosed. However, despite that fact, all items could have a material impact on the company’s financials and must be disclosed. Information to be disclosed includes details about mergers and acquisitions, contingent assets and liabilities, material or non-material losses, goodwill impairment or impairment of assets recorded using the revaluation model, etc.

What is the information to be disclosed when referring to the full disclosure principle?

Financial analysts who are reading the financial statements would like to know what inventory valuation method has been used, significant write-downs that might have occurred, or which depreciation methodology is being followed by the company. Information related to all these questions will be found in the disclosures on the financial statements. Organizations that are in an area of high risk should be required to disclose this information to its stakeholders.